“Good medicine tastes bitter.

– Old Japanese Proverb

Overview

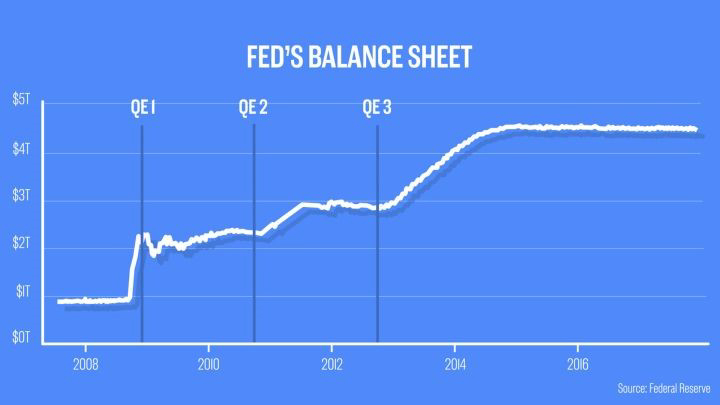

In the decade following the financial crisis, the US economy was fed on cheap lending and three periods of quantitative easing, which ballooned the Fed’s balance sheet five-fold and pushed rates down to artificially low levels. As the Fed attempts to normalize rates and heal the monetary system, the market is struggling to digest the bitter pill of higher rates and regain its independent footing. While the recent correction is unpleasant, it should come as no surprise given the market’s extended run as rates finally read just higher. We acknowledged the real possibility of this scenario at the beginning of the year and made a few decisions that have provided some protection to many of our clients:

- Shifted clients to models we felt better reflected their current risk tolerance in December and January

- Modestly reduced equity exposure in late January

- Avoided emerging markets {EM} given risk of a stronger dollar and EM’s large outperformance in

- Reduced interest rate exposure on risk of higher than expected infection.

In addition to higher interest rates, there are other headwinds as we approach the final months of 2018.

- Growth remains robust but trade tariffs cloud the outlook for certain industries

- China is slowing down and implementing stimulus

- EU and Italy are locked in a budget

- Split congress is becoming increasingly likely

INTEREST RATES HIGHEST IN 7½ YEARS

The increase in interest rates has ignited volatility and uncertainty across global markets in recent weeks as the US 10-year government bond yield raced to above 3.2% for the first time since July 2011. The rise is largely attributed to the Federal Reserve, who voted unanimously to raise the Fed funds rate in their September meeting and are likely to raise rates again in December (Fed fund futures pricing in 76% probability}. With the US government running its budget deficit to a six-year high of $779 billion as of Sept 30 (a 17% increase from a year ago}, the US Treasury has recently stepped up the size of its bond auctions, which have been drawing their worst (highest} yields since 2011. Foreign investors have shown little support as they now hold just 41% of outstanding Treasury debt; their lowest share in 15 years. They owned 50% as recently as 2013

INSTITUTIONAL BUYERS STEPPING BACK FROM US TREASURIES

By the end of September, hedge funds had built up a record level of short contracts against 10-year Treasury futures (according to the Commodity Futures Trading Commission}, which caused treasuries to lose nearly 1% in the month. While the short-end of the yield curve has risen, 30-year bonds are facing similar pressure as pension and insurance funds are stepping back. One Deutsche Bank analyst noted that corporate pension funds aggressively bought 30-year bonds to take advantage of a provision allowing businesses to deduct contributions to their employee pension plans, a benefit that expired in mid-September. The purchases, which were heavily front-loaded have slowed considerably in recent weeks— pushing the long-end of the curve higher.

Exceptional Growth

The recent Institute for Supply Management (ISM} services survey showed its highest reading in 21 years, coming in at 61.6. A score over 50 is viewed as positive and over 55 is considered exceptional. What is remarkable is that this score happens to be the highest level seen in the index throughout this 9-year expansion in what would typically be considered a very late phase in the growth cycle.

SOLID EARNINGS BUT GUIDANCE LESS OPTIMISTIC

Thus far while most companies have reported earnings ahead of analyst expectations for Q3; more companies have reported negative EPS guidance than positive EPS guidance for the upcoming quarter. This is being interpreted by many that the trade tariffs are beginning to have a real effect on the global economy. Two bellwether global industrial names of particular interest to the market were Caterpillar and 3M, which both issued unfavorable outlooks citing higher material and manufacturing costs due to tariffs. Recently Ford similarly blamed tariffs for higher steel prices.

Challenges Abroad China’s growth fell to 6.5% in the third quarter, its slowest pace since early 2009. The country has responded by unveiling a stimulus package that is expected to include major tax and fee cuts that could be worth more than 1% of GDP and increase infrastructure spending.

Europe is facing its own set of challenges as the European Union rejected Italy’s proposed 2019 budget, a first in the EU’s history. Under EU rules, Italy has three weeks to revise its budget but the country’s leadership has vowed to defy the EU and press on with its fiscal plans.

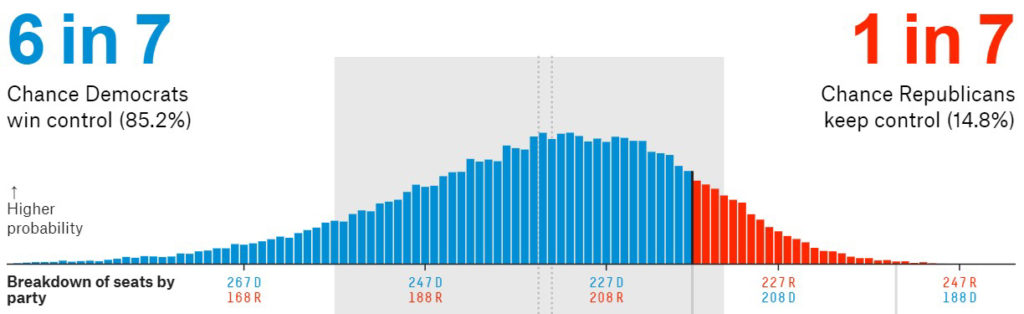

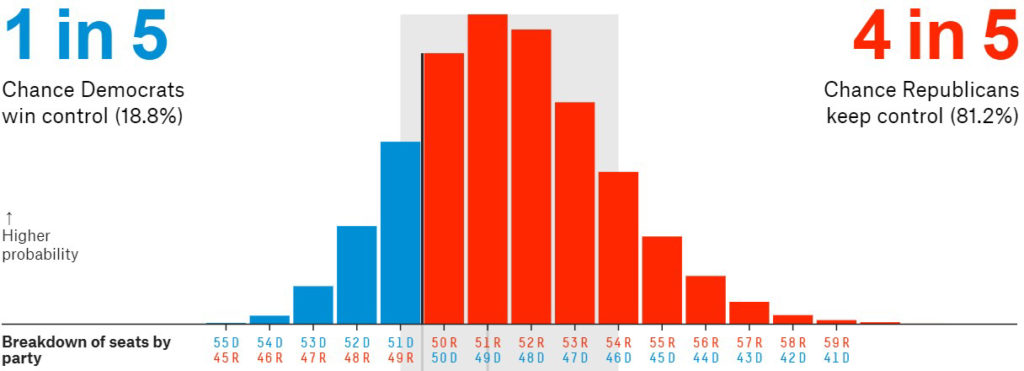

A SPLIT CONGRESS?

At this point the Democrats appear more likely to regain control of the House while the GOP has a good chance of retaining control of the Senate. In the House the Dems need to flip 23 seats to change control and of the 111 seats up for competition (Cook Political Report}, 98 are held by Republicans. While the Dems need to flip just two seats to take the Senate, of the 13 seats up for grabs, 8 are held by Democrats. Historically stocks have tended to perform better under united government and there are concerns that a split government could make it more difficult for the two sides to agree on an infrastructure bill.

SUMMARY

October has been a particularly harsh month for investors. With stocks already down more than 10% from their highs in correction territory, a considerable amount of pessimism has been priced into the market. Since the beginning of the month, the VIX (fear gauge} has more than doubled from 11.63 to 25.23 (as of Oct 24}. This is a fairly rare occurrence and often signals that markets may be oversold. Another indication of how hard markets have sold off is the Nasdaq’s RSI (relative strength indi- cator}, which fell to as low as 18.72 on October 11; marking the lowest level since the dot-com crash of 2001 (a score below 30 is commonly interpreted as oversold}. At this point the S&P’s forward P/E multiple has narrowed to 15.2x, down from 19x at the start of the year; its lowest valuation since early 2016. While we may see more nervousness in the coming days, as long as the real economy does not slow significantly faster than is anticipated due to tariffs or higher cost of capital, current valuations appear reasonable for the medium term.