“Fear is a force that sharpens your senses. Being afraid is a state of paralysis in which you can’t do anything.”

– Marcus Luttrell

Overview

Perhaps it is fitting to talk about fear as we come into October with Halloween right around the corner. This last quarter has brought on a host of new issues that have heightened the public’s level of anxiety. While renewed concerns of a trade war with China, escalating riots in Hong Kong, a genuine (albeit brief) inverted yield curve, prospects of a no-deal Brexit, and a rising threat of impeachment do not fully encapsulate global fears, they do provide some picture of the current public sentiment. Such times, however, tend to sharpen our senses and encourage deeper contemplation regarding the current state of our economy. It is during such periods we would be wise to take preemptive action to cope with future uncertainty.

Given the multitude of issues mentioned here, some readers may be surprised that the S&P 500 and Dow Jones posted their best first three-quarter starts to a year since 1997 (the Nasdaq’s best three-quarter start since 2013). How did this happen? Despite an avalanche of negative headlines in recent months, two rate cuts from the Fed this last quarter certainly provided a boost. While recent news has indeed been daunting, there are other potential catalysts that can lead to restoring a more stable environment. A partial trade deal with China is a step in the right direction (although there is still much to be done), and a Brexit deal no longer sounds like an impossibility. Next week’s earnings will be instructive and expectations are low.

The Un-Inversion—How Long Will it Last?

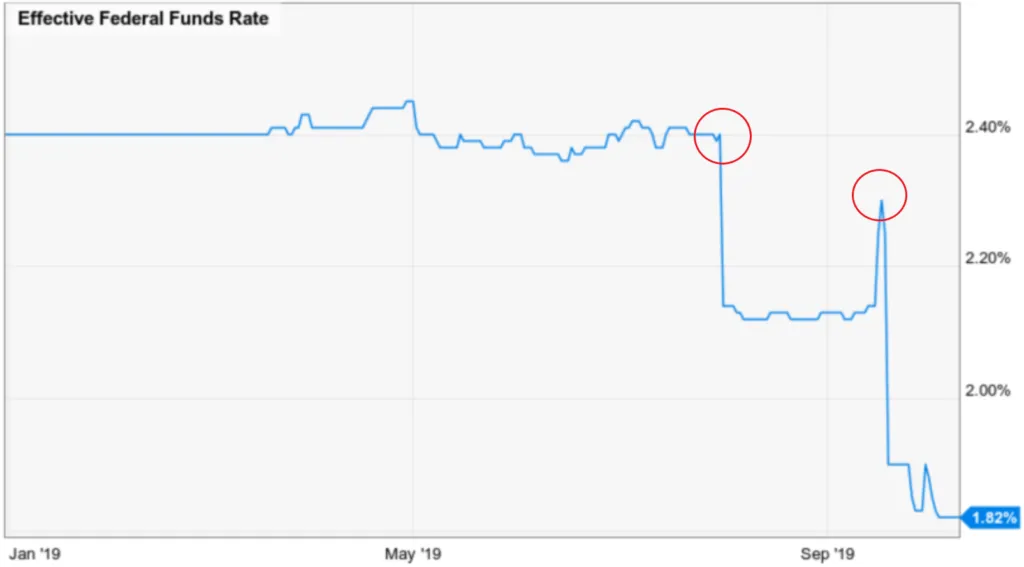

This year, the yield curve inverted at two key points that caused concern for investors. The difference between 3-month and 10-year treasury rates turned negative in May and later the difference between 2-year and 10-year Treasury rates turned negative in August. More recently, however, both points of these curves un-inverted and turned slightly positive. While the duration period of the curve inversion was short-lived, the signal is significant because every US recession since 1950 has been preceded by a yield curve inversion. However, not every instance of an inversion has led to a recession. In fact, there have been two false positives in the last 70 years—one in 1965 and the other in 1998. While there are some who are hopeful this could be another false positive, it seems fairly clear that the current economic expansion is indeed in its late stages given signals of slowing job growth, lower manufacturing activity, and shrinking corporate profits. Likely the biggest contributing factor to the un-inversion is the Federal Reserve, who cut interest rates two times this past quarter (bringing down short-term rates). The July 31 rate cut of 0.25% was the first since the 2008 Financial Crisis. The second, occurring on September 18, lowered the Federal Reserve’s target rate to 1.75% – 2%. Going forward, policy makers appear divided on the handling of future monetary policy. In their September statement, just seven of the 17 officials support an additional rate cut by the end of the year. Five officials believe no further cuts are needed and another five actually support a rate hike. The market is more dovish, pricing in a 67% probability of another cut in October.

Last Minute Deals!

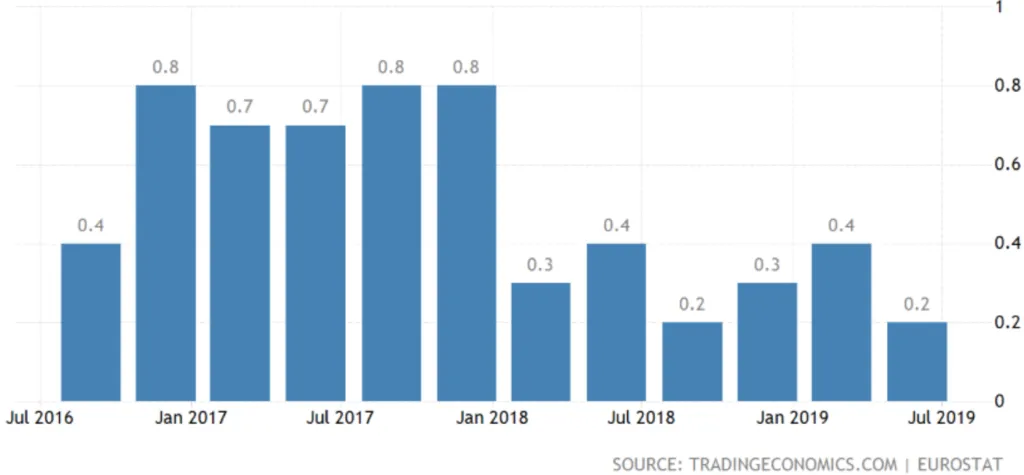

While economic growth has remained fairly stable in the US, it stands in stark contrast to growth overseas. Europe, in particular, has shown very anemic growth. After seeing some slight improvement over the last year, Eurozone growth slowed again to a one-year low of 0.2%. Germany, which represents the largest economy in the Europe, actually saw its economy decline by 0.1%. The UK, meanwhile, is in a critical point in time. The country is scheduled to depart the EU at 11:00pm GMT on October 31 and government leaders are negotiating furiously to work out a deal before the deadline.

Meanwhile China’s slowdown has continued to worsen. On September 15, China’s Premier Li Keqiang said it would be “very difficult” for their economy to maintain 6% growth in the current global climate; a level China has comfortably maintained for three decades. That global climate became more challenging last quarter after the US announced in early August it would raise additional tariffs on China and also designated the country a “currency manipulator.” While the partial trade deal between the two countries on October 11 should be taken positively, the countries have shelved the difficult issues and there remains significant work to be done.

Peachy About Impeachment

Although much has been said in the news media about a potential impeachment inquiry of President Donald Trump, financial markets have showed little reaction. The impeachment process is handled exclusively within Congress—with a simple majority in the House required to start the process and a 2/3 vote needed in the Senate for a conviction. With just 45 Democrats in the Senate and two independents who tend to vote Democrat, a conviction would likely require at least an additional 20 Republicans to vote for his removal; a seemingly unlikely scenario, which is why investors have largely shrugged off the prospect. Additionally, impeachment historically has not had a significant impact on markets. The S&P 500 lost 13% during President Nixon’s impeachment process but the market was already amidst a recession at the time, making the impact difficult to discern. By contrast, the S&P 500 actually rallied 28% amidst President Clinton’s impeachment and stocks had already been rising well in advance of his impeachment proceedings.

What to Watch For

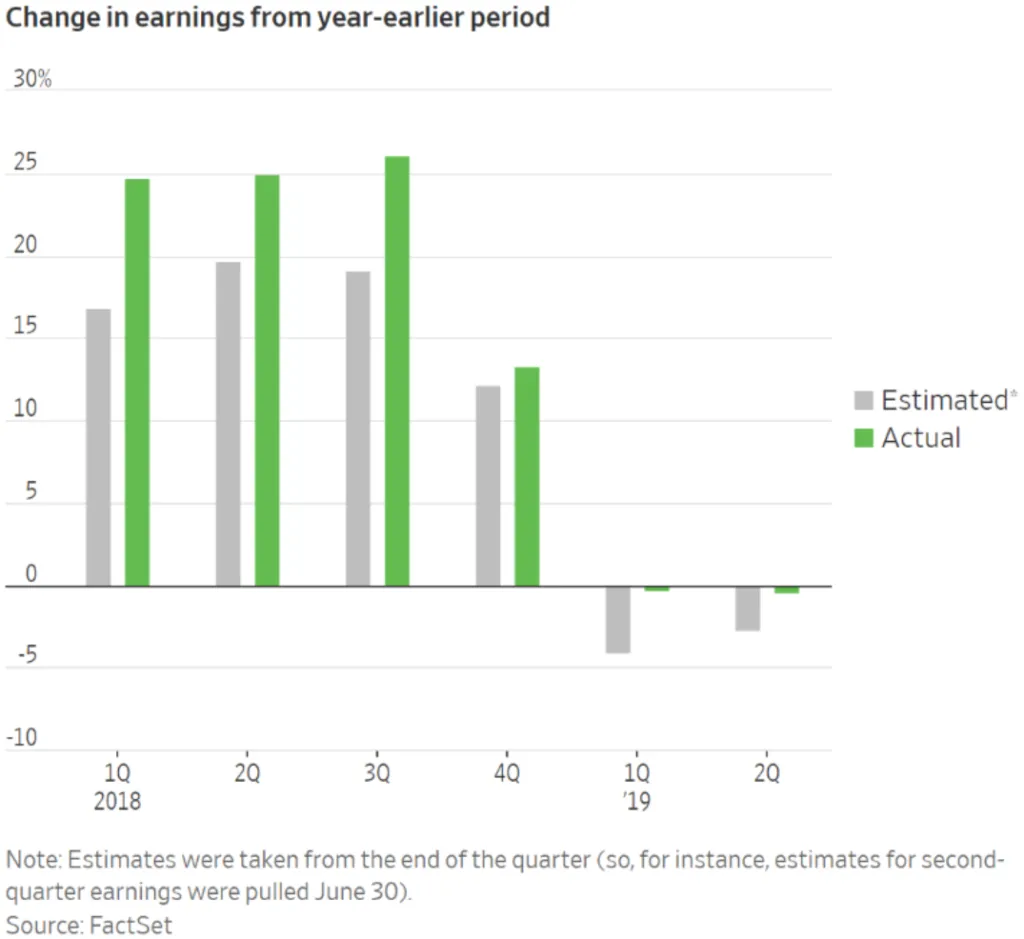

With the third quarter wrapped up, earnings season is set to kick off in earnest next week. Expectations are low as analysts are estimating a 4.5% drop in profits compared to a year ago, which would mark the third straight quarter of contraction. If the last two quarters have been any indication, analysts have been too pessimistic. Markets may react positively if their estimates prove to be overly bearish once again.