Life is like riding a bicycle.

Albert Einstein

To keep your balance,

You must keep moving.

Removing the Training Wheels

For the last year and a half, concerned about the US economy’s ability to sustain itself through a catastrophic pandemic, the Federal Reserve placed training wheels on the US monetary system that came in the form of a zero interest rate fed funds target and a quantitative easing (QE) program that involved the purchase of $120 billion of treasury and mortgage bonds monthly. With inflation readings across the board now hitting multi-year highs and oil prices climbing quickly, there is growing concern about the lasting effects these measures may have. The central bank is now giving indications that it will begin tapering its program and start paring back its bond purchases by this November, implying the buybacks could finish up by mid-2022 and set up a potential modest rate hike as soon as the end of next year.

Facing the prospect of reduced Fed support, stocks have become increasingly volatile and rates have gapped higher. September was the worst month for the S&P 500 this year. As the economy relearns how to function more independently, wobbles are to be expected and are likely to even continue in the coming months. Still coping with supply imbalances, worker shortages, and a recent economic slowdown, the question is, does the economy have sufficient momentum to carry itself forward as the training wheels come off?

Cooling Off in September

The S&P 500 fell 4.8% in September, the market’s worst month since March 2020 (when the pandemic started) and snapped a streak of seven months of consecutive gains. Investors could attribute the pullback to a wide array of factors—a dramatic rise in new COVID cases over the summer that prompted many economic forecasters to cut their Q3 targets as businesses slowed, a looming debt ceiling as legislators continue to struggle to find agreement on managing the nation’s budget, or even the toppling of a giant Shenzhen, China based property company that shook markets around the world. Despite all of these valid concerns, though, arguably the greater issue at the forefront is the matter of inflation, which Ronald Reagan once described as “violent as a mugger,” and “deadly as a hit man.”

Déjà vu?

Those ominous words expressed by the former president came in 1978 before he took office, but illustrate the grave economic challenges faced during that period when inflation reached as high as 15%. The events that preceded those extreme levels of inflation included a detachment from the gold standard, years of suppressed interest rates, and ballooning government spending, which have caused many to draw comparisons to actions being taken today— such as the implementation of extremely accommodative monetary policy and unprecedented fiscal stimulus. While such comparisons are provocative, they may be a bit premature. The Wall Street Journal compares this current period to the late 1960s, when inflation rose from below 2% to nearly 6% by the end of the decade. A series of policy missteps in the subsequent years, however, such as pressure from President Nixon on then Fed Chairman Arthur Burns, as well as the lack of an explicit inflation target served to acutely exacerbate the problem. Fed officials, very mindful of past history, in recent weeks have started addressing inflation concerns more directly.

Time to Address Inflation

After several months of reiterating a very accommodative tone, in September the Federal Open Market Committee acknowledged substantial progress towards its goals and said, “a moderation in the pace of asset purchases may soon be warranted.” This decision to begin paring back its monetary support coincides with two negative trends: the Fed raising its inflation forecast for the year from 3.4% to 4.2%, while simultaneously cutting its growth outlook for 2021 from 7% to 5.9%. Its indications to begin reducing its QE program in the face of a lower GDP target signals greater concern towards inflation than growth.

Lurking in the Shadows

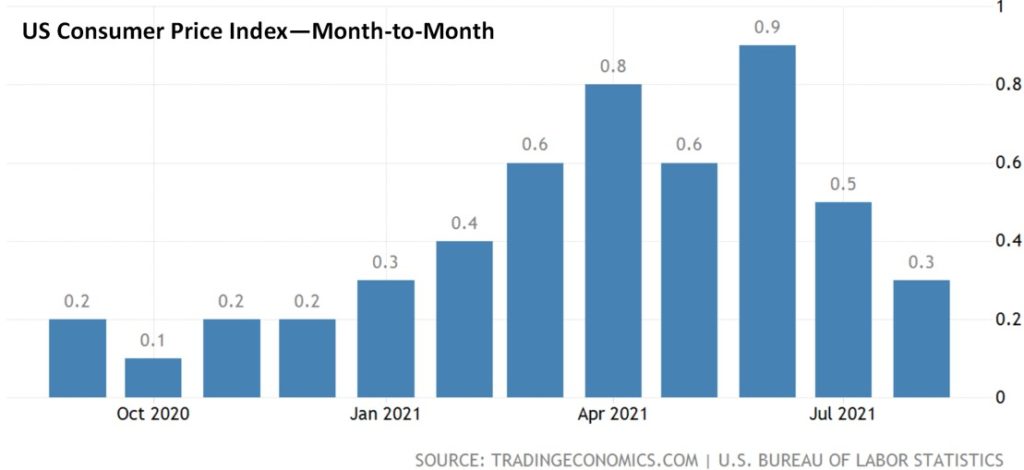

While the headline Consumer Price Index (CPI) data indicates inflation has decelerated in recent months, many economists are concerned about data not yet being reflected in the price gauge: large rent increases likely to hit tenants next year.

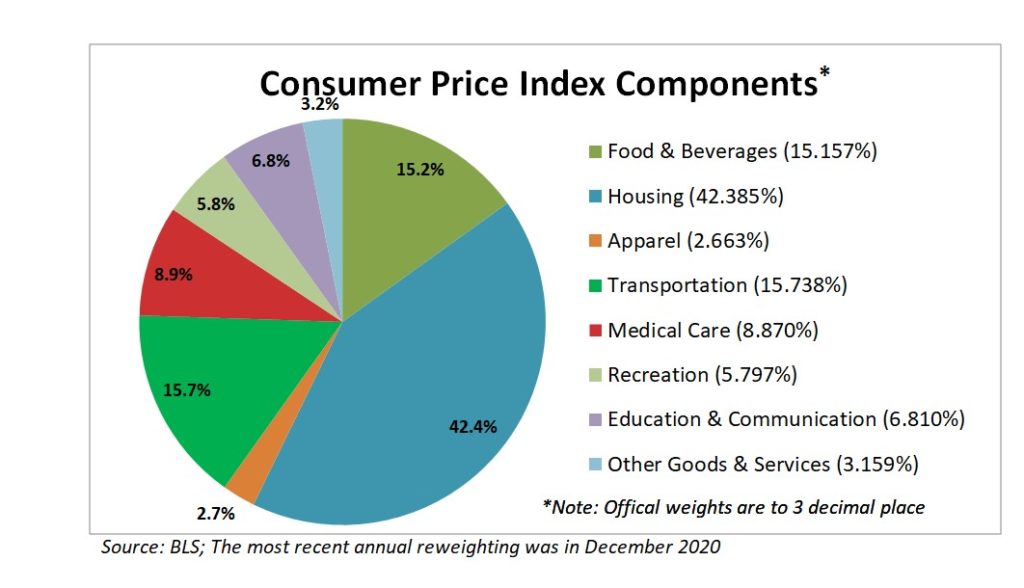

As of the end of September, home prices across the nation rose 19.7% from a year ago, according to Case-Shiller. Dallas Fed economists Xiaoqing Zhou and Jim Dolmas wrote that higher home prices are a leading indicator for higher rents, typically with an 18-month lag time. Even with the CPI hitting 13-year highs, the price increases so far do not account for the rent increases likely to come. This is an important point as housing costs account for roughly 40% of the CPI’s total measurement.

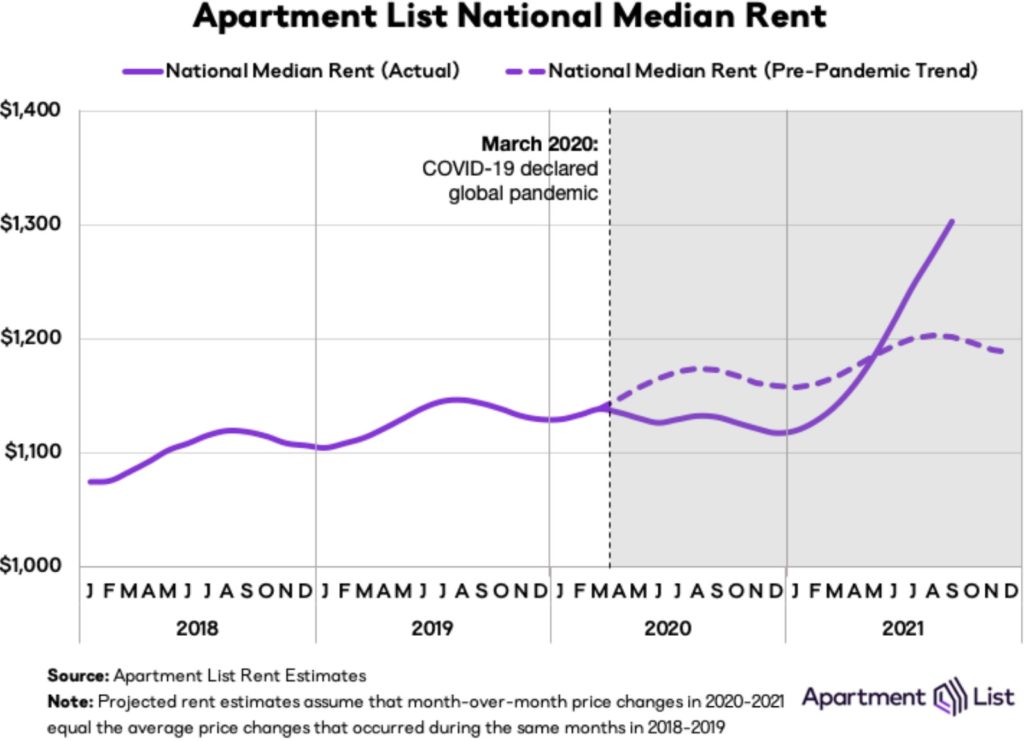

While single family home rents have not yet moved significantly, we are already seeing apartment rents spike considerably higher. According to Apartment List, all 100 of the US’s largest metro areas have seen month-over-month rent increases for five straight months, with a national increase of 11.5%, according to Zillow.

As rent prices continue to escalate higher, economists are naturally concerned that the increased housing costs could push inflation rates above the Fed’s 2% target in the coming years even after current supply bottlenecks and labor shortages have normalized.

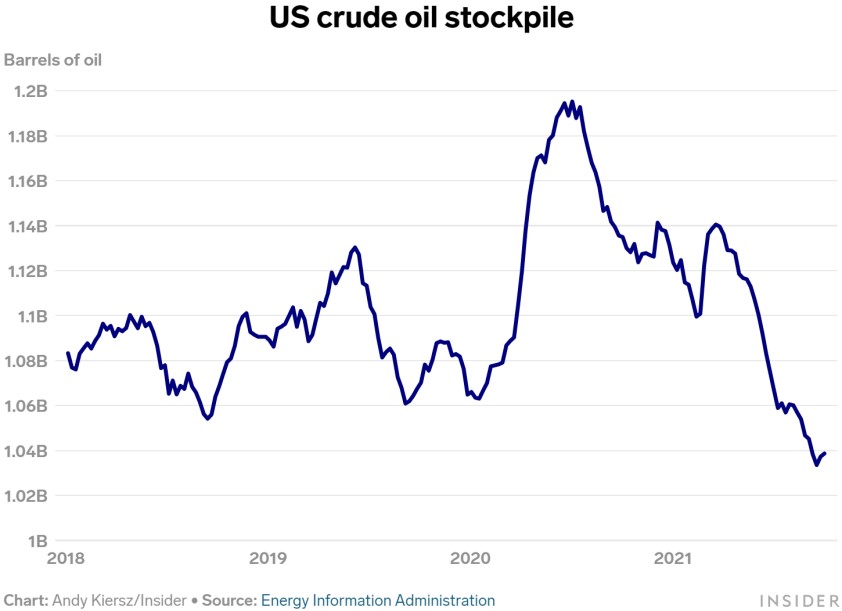

Gas Prices Highest in Seven Years

The resource that has perhaps been most noticeably affected, though, is energy. Gas prices hit their highest level since October 2014. With the economy reopening this year, highway traffic is up 30% since January with more people back on the road. At the same time, OPEC and other oil-exporting countries have constrained production to keep prices higher and Hurricane Ida also drastically reduced domestic production, shutting down several rigs and refineries in August. This has left US crude oil stockpiles at their lowest levels since 2014.

Is there Sufficient Momentum to Carry Through?

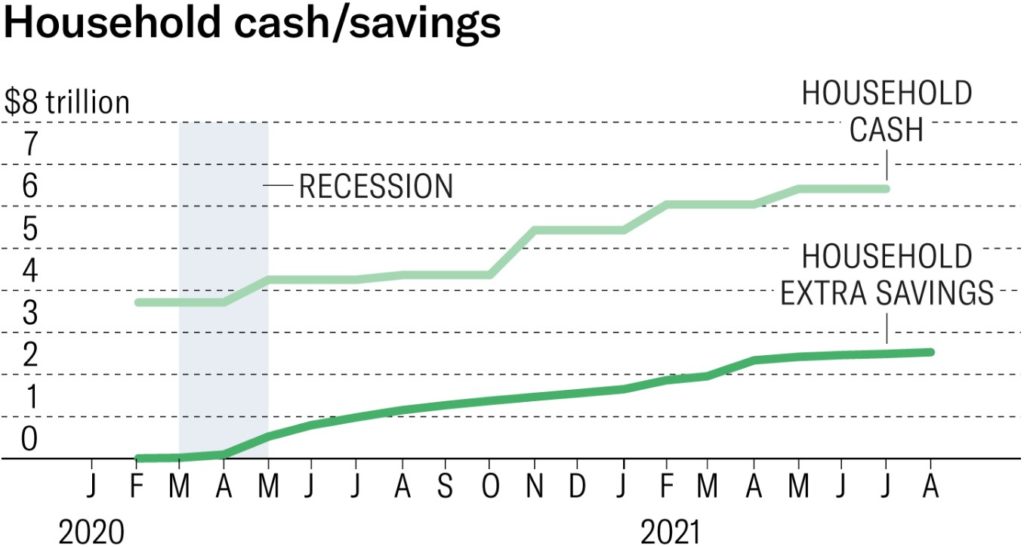

Despite the combination of its inflation concerns and its growth cut for 2021, the Fed raised its target for 2022 from 3.3% to 3.8%. While prices may be rising, household savings and net wealth have risen dramatically to put consumers in a position to pick up the expansion.

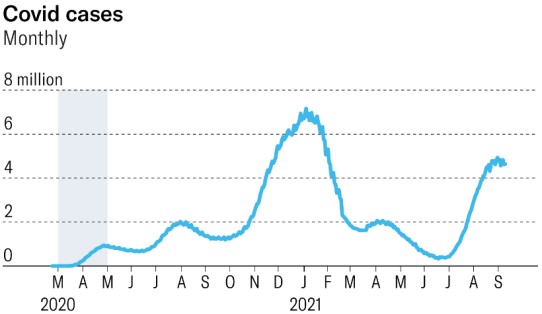

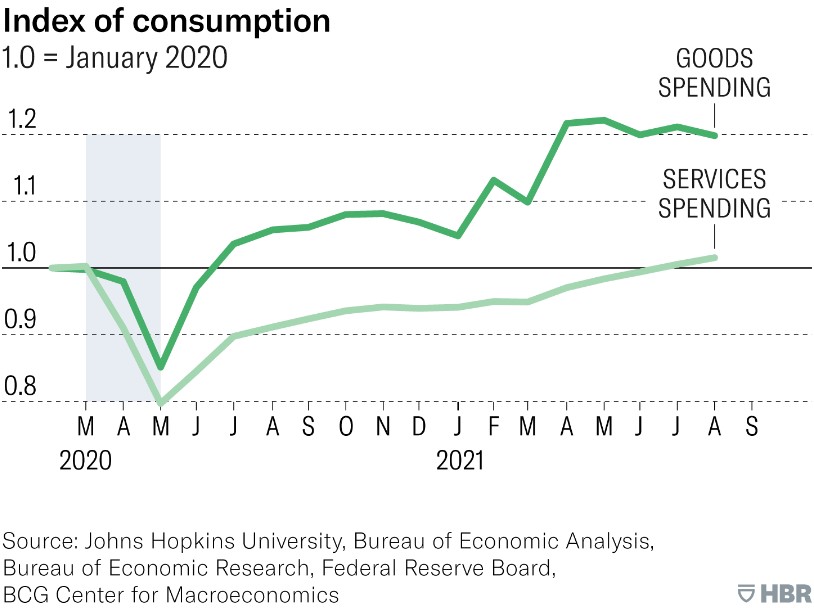

Additionally, a recent report from the Harvard Business Review indicated that “the economy largely decoupled from the virus early on,” and that the recovery has not been driven just by heavy doses of stimulus, but also by households and businesses adapting and learning to live with the virus. This knowledge and adaptability is unlikely to be undone by the Delta variant.

Productivity Growth: A Critical Piece of the Puzzle

As the labor shortage has driven wages higher, one way companies have adapted is by dramatically increasing their investments in technology and information-processing equipment far above long term trends. A survey conducted by the World Economic Forum indicated that between 85-95% of companies were accelerating or looking to accelerate the digitization of their work processes due to COVID-19. Such investment is already starting to yield significant gains in productivity. For example, after averaging around 1% annual growth in productivity from 2013-2018, the US experienced 3% growth in the first half of 2021 alone.

Necessity is the Mother of Invention

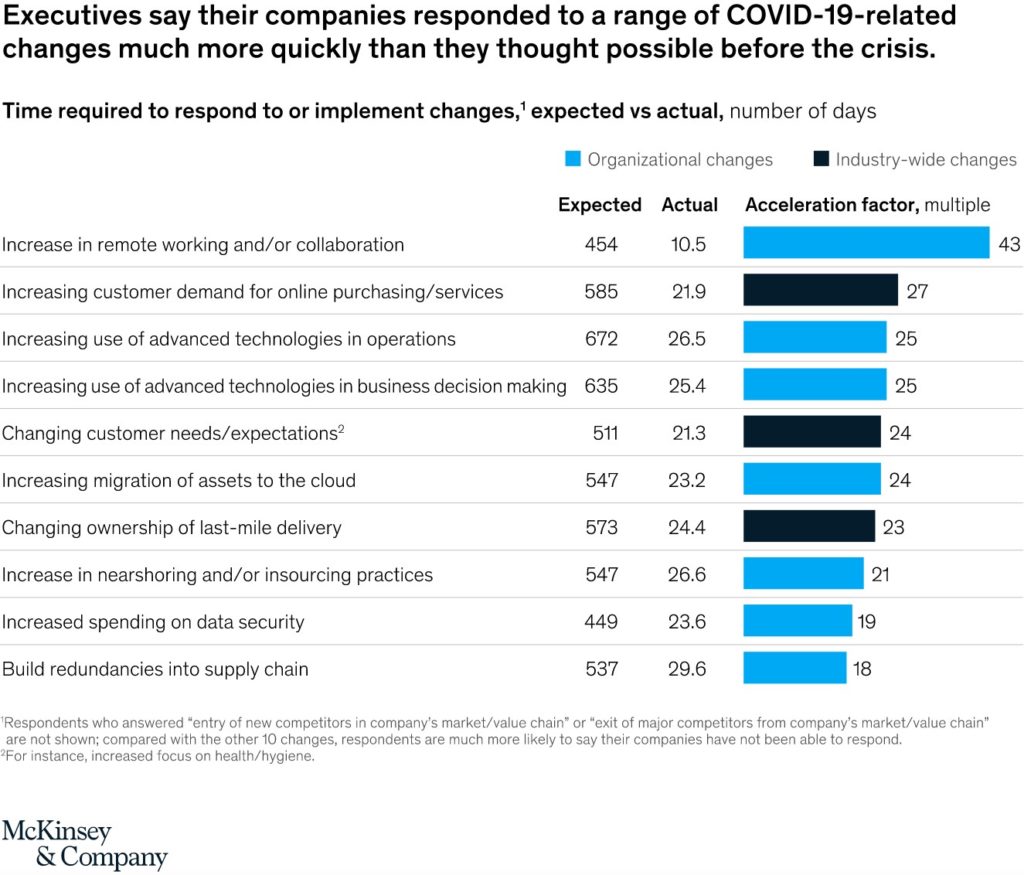

The pandemic has actually served to accelerate the digitization of business. According to a McKinsey Global Survey of executives, for some of the changes, they said their companies made improvements 20-25 times faster than they had anticipated. In the case of remote working, companies moved around 40 times more quickly than they thought possible prior to the pandemic. When asked why their organizations neglected to make such innovations before the crisis, a little over half of those polled said it was not a top priority.

Such developments have been very positive for business productivity, and there is evidence businesses are continuing to invest for the future. New orders for US-manufactured durable goods, a leading indicator of business investment, have increased 15 of the past 16 months. The McKinsey Global Institute (MGI) research finds that there is potential to accelerate annual productivity growth by one percentage point through 2024, which would double the rate of pre-pandemic productivity growth. The importance of productivity was described by economist Paul Krugman, who said, “productivity isn’t everything but, in the long run, it is almost everything.”

Such improvements in efficiencies will be critical in empowering the economy to continue its expansion independently as the Fed gradually removes its monetary support. As we think back to that childhood experience of learning to ride a bike, the thought of going it alone understandably stirred up nervousness and likely even induced some wobbliness. As the market experiences similar wobbles, we should remember this is sometimes a natural and necessary process in the journey forward.