"To expect the unexpected shows a thoroughly modern intellect. "

-Oscar Wilde

Expect the Unexpected

A year ago, economists from the World Economic Forum declared growth prospects were anemic and global recession risks were high. A large majority of economists across several polls expected a recession to hit in 2023 and many believed we were already in one. Those sentiments have shifted dramatically in early 2024. A recession this year is now no longer the consensus. US consumer sentiment just rose by the most over a two-month period since 1991; the gauge rose by 29% since November, according to the University of Michigan. While higher consumer sentiment has not historically been a useful predictor of future stock performance, it has generally given consumers greater confidence to continue spending, which is the main engine of the US economy. Additionally, job growth has turned higher again, corporate earnings estimates have been raised, and core retail sales jumped last month.

Such developments are simultaneously reducing recession fears and increasing hopes of a soft landing. However, is it possible investors may have been worrying about the wrong thing all along? What if the greater risk is actually reacceleration? Much of the recent gains in the stock market is pinned on the expectation of significant rate cuts in 2024. Those rate cuts are likely dependent on an economic slowdown. But if the economy reaccelerates and that gets taken off the table, where would that leave us? The inflationary 1970s were fraught with monetary policy fits and spurts. Could we experience a similar fate? As the market hits new highs and recession fears are largely assuaged for now, the potential risk of reinflation hasn’t gone away. If the last year has taught us anything, it’s that we should expect the unexpected.

When are the Rate Cuts Coming?

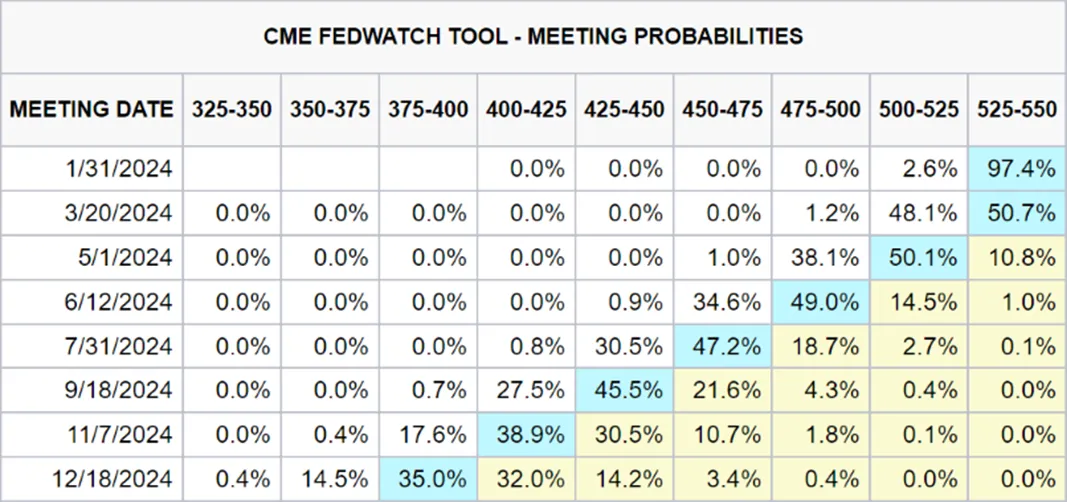

So what is the market expecting for rate cuts? At present, the market is pricing in about 50/50 odds of a first rate cut in March. Those odds have been trending down recently, though. A month ago, the market was pricing in a 75% chance of a March cut. Assuming no rate adjustment in January, this would imply that the Fed would cut rates in six of the remaining seven meetings in 2024.

This is a fairly different picture than guidance we’ve received from the Fed. On December 13 of last year, the Federal Reserve updated its Summary of Economic Projections. For 2024, the Fed is only guiding for three rates cuts this year, which is already two more than what they guided for in September.

Most economists are generally expecting the cuts to come a bit later as well. In a Wall Street Journal survey of 71 economists conducted between January 5-9, the most frequent response was for a first rate cut in June, which would be the fourth meeting of the year.

Is a Recession Necessary for the Fed to Cut Rates?

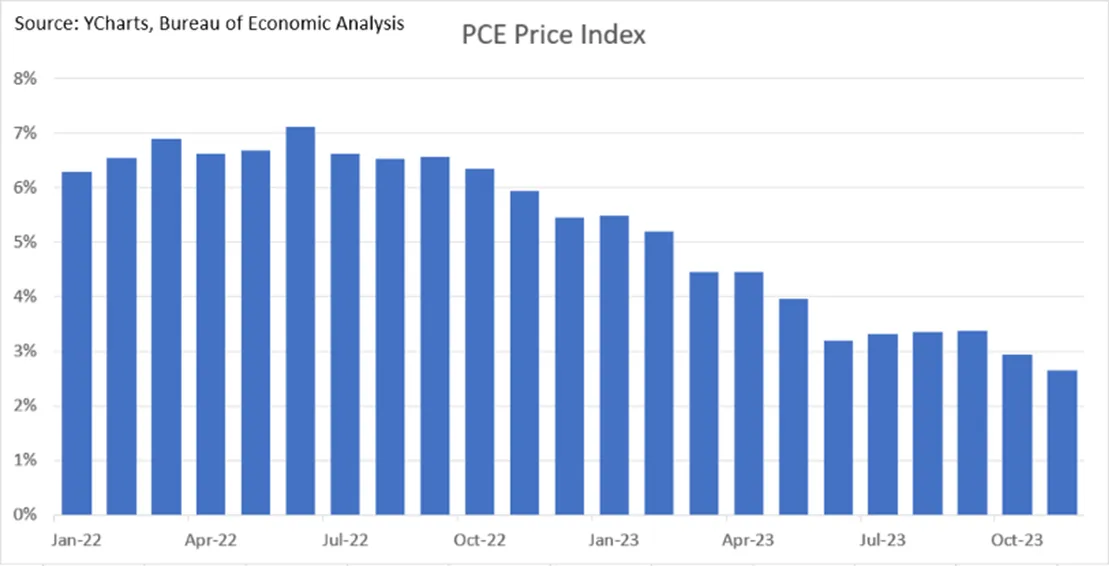

Although the majority of analysts are not necessarily forecasting a recession this year, most still expect the Fed to begin cutting rates within the next 12 months. The Fed’s favorite inflation measure, the Personal Consumption Expenditures (PCE) Index, has fallen steadily over the past several months to below 3% since October. The PCE Index essentially represents the prices that Americans pay for goods (durable and non-durable) and services. With the gauge beginning to approach the Fed’s long term inflation goal of 2%, we may see the Fed begin cutting interest rates even absent a recession. However, the key to rates coming down is that inflation continues to trend lower. If prices beginning turning back up, Fed officials have made it clear that they remain open to the possibility of having to raise interest rates once again. Fed Chair Jerome Powell remarked last month, “We are prepared to tighten policy further if it becomes appropriate to do so.”

What are the Risks that Inflation Comes Back?

There have been a number of inflationary factors beginning to re-emerge. For instance, job growth has started to swing back up. Generally speaking, steady monthly job growth is typically perceived to be between 50k-100k based on the current size of the population, The last few months have seen markedly higher job growth than that, and December nonfarm payrolls showed an increase of 216,000. There are other signs the labor market remains tight; wage growth remains above 4% and job openings are still around 8.8 million, which is well above the number of individuals seeking employment.

Additionally, S&P 500 earnings are expected to be significantly higher this year. As we await the rest of last year’s Q4 results to be reported, analysts estimate 2024 corporate profits to be up about 12% from last year. If realized, this would be the biggest yearly increase since 2021, which came after 2020’s economic shutdown. The increase is not expected to be a one-off either. Analysts expect profits to accelerate even faster in 2025.

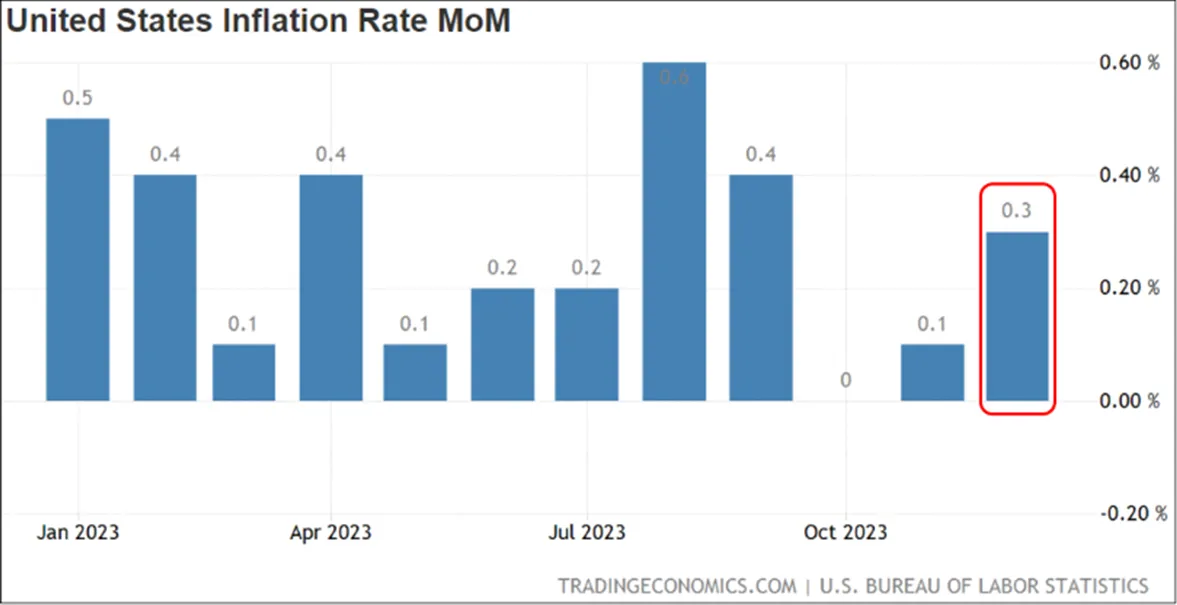

This also coincides with headline inflation turning higher last month as well. December’s Consumer Price Index (CPI) unexpectedly rose 3.4% from a year ago and 0.3% for the month. Core inflation, which strips out food and energy prices, was up 3.9%. While some will argue that shelter costs are being overstated and question the validity of the CPI report, the fact remains that the overall measure did indeed turn higher from previous months.

It wasn’t just the US that saw reflation either. Eurozone inflation accelerated 2.9% last December, reversing six consecutive months of declines. While core inflation in the US and Europe, has continued to gradually improve, the overall inflation picture remains mixed and still well above the long term target of the respective economies.

Supply Chains Are Functioning Better for Now

Up to this point, much of the improvement in price stability can be attributed to restored functionality in the world’s supply chains. In an article published in The Wall Street Journal earlier this month, new research indicated that the supply chain congestions were far more persistent than many economists had anticipated. This could also partly explain why inflation was so persistent and why inflation has fallen despite unemployment remaining historically low.

For the same reason, market participants should be mindful of some of the emerging issues that are affecting a couple of major supply chain hubs. The recent attacks on freight ships in the Red Sea linked to the Israel-Hamas War and the massive traffic cuts occurring in the Panama Canal due to a significant drop in water levels caused by a historic drought could potentially have an inflationary effect if these supply shocks become contagious.

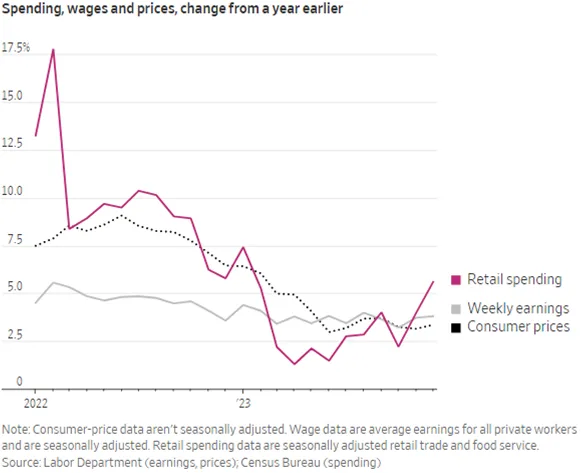

While supply has generally stabilized, demand has remained surprisingly resilient. US retail spending has accelerated in recent months, with holiday sales hitting new records at the end of last year. Furthermore, consumer sentiment has increased dramatically, likely aided by a drop in gasoline prices and a strong rise in the stock market.

Continued strong demand from the US consumer has led to pricing power at US companies. A study from Groundwork Collaborative found that 53% of the inflationary price increases are attributable to corporate profits, sometimes colloquially referred to as “greedflation.” The study found that although company costs have slowed dramatically, they have continued to push their costs up. Liz Pancotti, a co-author of the study, remarked, “Costs have come down substantially, and while corporations were quick to pass on their increased costs to consumers, they are surprisingly less quick to pass on their savings to consumers.”

A Presidential Election Year

The other crosscurrent investors are considering in 2024 is the country’s quadrennial presidential election. Generally speaking, annual stock performance in election years compared to non-election years has been non-discernable. However, Barron’s pointed out a fascinating pattern in election years: stocks tend to perform poorly during the first half of the year but particularly well during the second half.

Morgan Stanley contrasted the average performance of Democrat and Republican election years. In the 23 election years since the S&P 500 began, the index rose on 19 occasions (83% of the time).

Mind the Valuations

There are indeed a number of positive factors working in favor of the American economy at the start of this year. Low unemployment, strong consumer spending, and growing corporate profits provide the ingredients for healthy growth. With the stock market hitting new all-time highs, however, strong expectations are already built in. Furthermore, current stock valuations are largely based on inflation moving lower at a steady pace. While much of the optimism is understandable, investors should still be open to the possibility of reflation that could be driven by a variety of factors: a tightening labor market pushing service costs higher, stronger than expected consumer spending, and new supply chain disruptions, to name a few. There are indeed a plethora of reasons to be positive for now; but keep an open mind to unexpected surprises. We’ve seen plenty of them and there are likely plenty more to come.